How Gold Protects Your Privacy and Independence

When it comes to securing financial privacy and independence, gold stands apart as a valuable, tangible asset that can operate outside traditional financial systems. In an era where every digital transaction is tracked, scrutinized, and sometimes even shared with third parties, gold offers a unique layer of financial autonomy. Skeptical about the promises of modern banking? Gold might just be the perfect solution for you.

The Financial Privacy Concerns of Modern Banking

In today’s banking environment, personal data is heavily monitored and shared. Digital transactions leave a trail accessible to governments, creditors, and even hackers in certain situations. Traditional banks require personal information and identity verification that can compromise your privacy. With financial data being one of the most targeted types of information by hackers, this dependency on digital banking can expose your finances to risks. Moreover, banks often comply with government requests to freeze or access accounts, further reducing individual autonomy.

Gold, on the other hand, provides a private, self-contained asset that is out of reach of external interference. For anyone seeking privacy, the value of owning a physical, non-traceable commodity like gold becomes incredibly clear.

The Value of Financial Privacy Independence

Unlike savings accounts and stock holdings that require brokers, institutions, and online platforms to access and manage, gold is accessible directly. This independence can be a key advantage in times of crisis or economic downturns when reliance on digital access to funds may not be reliable. Gold isn’t affected by regional banking restrictions, fees, or the controls imposed on electronic money. You have full control over your holdings without needing intermediaries.

Gold as a Crisis Asset

Consider how, during the 2008 financial crisis, traditional banking faced immense setbacks. Bank failures and government bailouts forced depositors to question the safety of their assets. The result? A significant rise in gold prices, as individuals and institutions alike turned to gold as a refuge. Those who had their savings in physical gold were able to maintain the value of their wealth, even as financial systems faltered.

In Numbers: According to historical data, gold appreciated by over 30% from 2007 to 2009, showing its resilience in times of economic instability. Meanwhile, the stock market took nearly five years to recover fully.

How Gold Secures Privacy and Avoids Unnecessary Fees

The banking industry frequently imposes fees on checking accounts, savings accounts, and other standard transactions. Annual fees, ATM fees, overdraft charges, and low-balance fees can add up, cutting into your savings. By transitioning to gold, investors can avoid many of these routine charges and hold an asset that doesn’t require constant oversight by banks.

Gold also keeps your savings immune from inflation. As fiat currency devalues, purchasing power decreases, meaning your savings are worth less each year. Gold, however, typically maintains its intrinsic value over time. As an example, in the past decade, the purchasing power of the U.S. dollar declined by approximately 20%, while gold prices rose by about 50%, showing its effectiveness as a hedge against inflation.

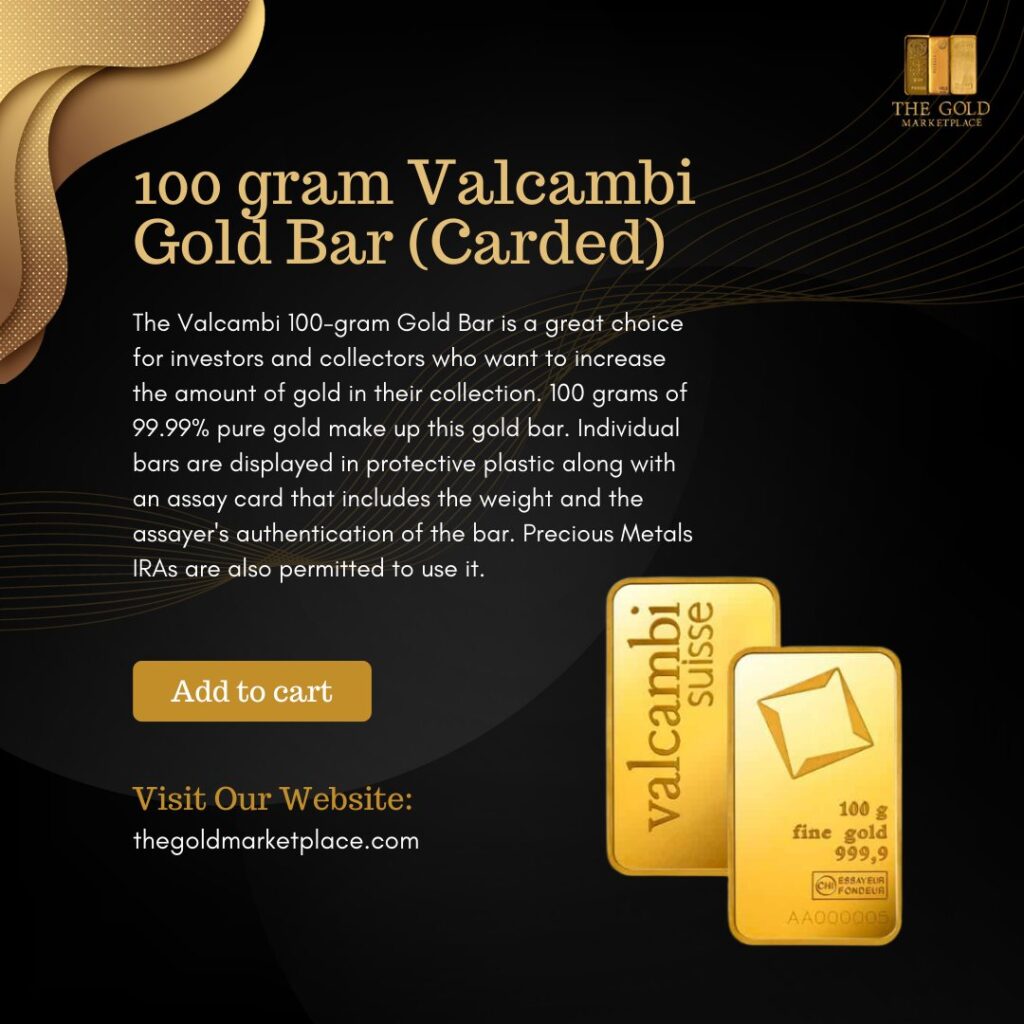

Protecting Your Savings: Consider Our Gold Products

When it comes to achieving financial privacy and independence, investing in high-quality gold products can make all the difference. At The Gold Marketplace, LLC, we offer a range of gold coins and bars that can serve as a long-term wealth store and a valuable asset in uncertain times. Whether you’re a first-time buyer or an experienced investor, our offerings are tailored to meet various financial needs.

Start Your Gold IRA Journey Today

For those looking to incorporate gold into a retirement strategy, a Gold IRA can be a powerful choice. Our Gold IRA Guide offers a comprehensive overview of how to set up a Gold IRA and maximize its benefits. By investing in a Gold IRA, you can achieve the same financial privacy and independence as owning physical gold while enjoying the tax advantages typically associated with retirement accounts.

Take a Deeper Dive into the System with “Gold vs The Banking Cartel”

Our book, Gold vs The Banking Cartel, explores the downsides of conventional banking, the hidden fees, and the risks associated with an over-reliance on fiat currency. This comprehensive guide uncovers how gold can serve as a safeguard against inflation and currency devaluation, while providing you with independence from the constraints of banking. It’s a must-read for anyone serious about building a stable and private wealth portfolio.

Final Thoughts

Gold remains a stronghold of privacy and independence, making it an ideal choice for skeptics of modern banking. Its resilience in economic crises, ability to avoid banking fees, and immunity to inflation make it a powerful alternative to traditional savings. By shifting part of your wealth into gold, you are not only diversifying but also building a foundation for long-term financial freedom.

Ready to Protect Your Wealth? Explore our products at The Gold Marketplace, LLC. Start your journey toward a safer, more private financial future.