Storing Gold Outside the System: Safes, Vaults, and Offshore Solutions

In this article, we’ll explore the advantages of storing gold securely beyond the traditional financial system, covering solutions like home safes, private vaults, and offshore storage. In today’s uncertain economic landscape, more individuals are re-evaluating where and how to store their wealth. Traditional bank accounts may no longer seem as safe or reliable, especially given recent financial crises and government interventions. For those who prioritize wealth protection and privacy, gold presents an appealing option—especially when stored outside conventional banking systems.

Why Store Gold Outside the Banking System?

One of the main reasons people turn to gold is its intrinsic value and immunity from the risks associated with digital money and inflation. Unlike bank-held assets, gold stored in private, secure locations provides both security and independence, shielding it from bank failures, government freezes, and economic downturns.

For instance, the 2008 financial crisis caused widespread fear as banks struggled, leaving many unable to access their savings. Today, while banks may seem stable, inflation is silently diminishing the value of cash holdings. Gold, on the other hand, has historically retained its value over time and offers more direct control over wealth.

Storing Gold: Home Safes for Security and Accessibility

If you prefer to keep gold close, a home safe could be the right choice. Home safes offer quick access to your assets and allow you to personally oversee their security. However, it’s essential to choose a high-quality, fire-resistant safe that is firmly bolted down in a discreet location within your home.

For added security, consider blending your safe into your home’s design. Hidden safes disguised as everyday furniture pieces are becoming increasingly popular among those who want to add another layer of protection against potential intruders. Keep in mind, though, that storing gold at home still carries some risk and may not suit everyone’s comfort level.

Private Vaults: Maximum Security for Storing Gold

A popular option for larger gold holdings is a private vault, offering high security and a protective buffer from potential theft. These vaults are specifically designed for storing valuable assets and often feature layers of security that include biometric access, 24/7 surveillance, and fireproof designs. Companies such as Brinks and Loomis offer such facilities, providing peace of mind with professional storage solutions.

Private vaults also have the advantage of separating your assets from financial institutions, safeguarding your wealth from possible banking or governmental restrictions. Although this option requires a storage fee, many consider it worthwhile for the added protection.

Storing Gold Offshore: Financial Privacy and Asset Protection

Offshore storage is the most robust option for those who seek additional layers of privacy and protection. Many investors choose international vaults in financially stable regions like Switzerland or Singapore to keep their assets out of reach from domestic regulatory changes. For example, during the 2020 financial turmoil, Swiss vaults saw a rise in demand as investors sought a safe haven for their wealth, illustrating how this strategy can provide both financial stability and peace of mind.

Offshore storage also offers certain tax advantages and allows investors to diversify their holdings internationally. However, it’s essential to research reputable facilities and ensure they meet international safety standards.

Protecting Your Wealth with Gold

If you’re ready to start safeguarding your wealth with gold, consider browsing our range of gold products tailored for every type of investor. Whether you’re looking to start small or make a substantial investment, we offer quality gold items that help secure your financial future.

Transitioning Your Portfolio: The Gold IRA Option

In addition to physical storage, our Gold IRA Guide can help you diversify your retirement savings into gold. With a Gold IRA, you receive the benefits of tax advantages while building a portfolio that safeguards against inflation and market volatility. Explore our Gold IRA Guide to learn how you can transition your savings effectively.

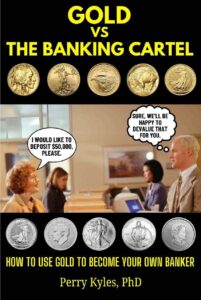

For a Deeper Dive, Read Gold vs. The Banking Cartel

For those interested in the larger economic implications of gold investing, our book, Gold vs. The Banking Cartel, offers valuable insights into the hidden costs of relying on banks and why gold remains a superior choice. Dive deeper into the history, economics, and strategies behind protecting wealth beyond the reach of the banking system.

Invest in your financial independence today. Discover how gold can serve as both a powerful store of value and a safe, private asset when the future feels uncertain.