Gold Jewelry as an Investment: Understanding Value, Purity, and Profitability

Gold jewelry is more than just a fashion statement; it is also an asset that holds intrinsic value over time. While many people buy gold jewelry for aesthetic or sentimental reasons, savvy investors recognize its potential as a financial hedge and wealth preservation tool. In this blog, we will explore the investment side of jewelries, including its resale value, purity, and how it compares to bullion as a store of wealth.

The Resale Value of Gold Jewelry: What Investors Should Know

One of the most common questions investors ask is whether jewelries retain their value over time. Unlike bullion, which is typically valued based on weight and purity alone, gold jewelry’s resale value is influenced by several key factors:

- Gold Content and Purity – The higher the purity of the gold (measured in karats), the more valuable the jewelry. For example, 24K gold is pure gold, while 18K gold contains 75% gold and 25% alloy metals.

- Craftsmanship and Brand – Designer gold jewelry or pieces from luxury brands like Cartier, Tiffany & Co., or Bulgari tend to have higher resale values due to craftsmanship and brand prestige.

- Market Demand and Economic Conditions – Gold prices fluctuate based on inflation, central bank policies, and geopolitical uncertainty. For instance, during the 2008 financial crisis, gold prices surged from $870 per ounce in January 2008 to $1,800 per ounce by 2011, leading to increased demand for gold jewelry resale.

Example: The 2024 Surge in Pre-Owned Gold Jewelry Sales

In 2024, gold prices reached an all-time high of $2,450 per ounce, fueled by inflation fears and central bank gold purchases. This led to a 45% increase in second-hand jewelry sales worldwide, as sellers sought to profit from high prices while buyers turned to jewelry as an alternative investment.

💡 Takeaway: Investors looking to resell gold jewelry should track global gold prices and market trends to sell when prices peak.

Shop Now: 10 mm 14k Two Tone Gold Pave Curb Chain

How Gold Purity and Karats Impact Investment Worth

The purity of gold jewelry is crucial in determining its investment potential. Gold is measured in karats (K), with higher karats indicating a higher percentage of gold content:

- 24K Gold (99.9% pure) – The most valuable but also the softest, making it prone to scratches.

- 22K Gold (91.7% pure) – Common in Indian and Middle Eastern jewelry, retains significant value.

- 18K Gold (75% pure) – A balance of durability and value, popular in luxury jewelry brands.

- 14K Gold (58.3% pure) – Common in the U.S. and Europe, affordable but with lower resale value.

Example: Why 22K Gold Jewelry Is a Preferred Investment in India

In India, gold is deeply ingrained in cultural and economic traditions. The Indian gold jewelry market accounts for nearly 30% of global gold demand, with 22K gold being the standard choice due to its balance of purity and durability. During India’s Diwali and wedding seasons, gold demand spikes, often influencing global gold prices.

💡 Takeaway: If you’re investing in jewelries, opt for higher karat pieces (18K or above) to maximize value retention while maintaining durability.

Shop Now: 10.0mm 14k Yellow Gold Classic Miami Cuban Solid Chain

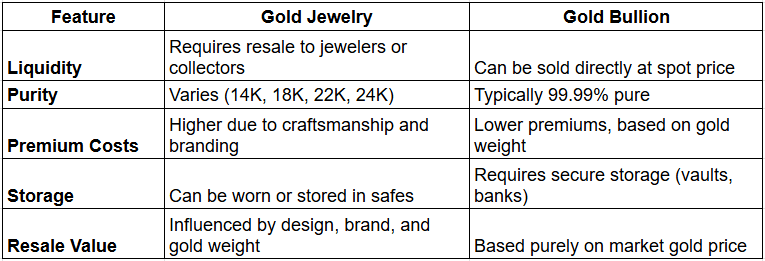

Comparing Gold Jewelry vs. Bullion: Which Holds Value Better?

When it comes to investing in gold, many wonder whether gold jewelry or bullion is the better choice. While both have advantages, they serve different purposes in an investment portfolio.

Example: The 2024 Bullion Investment Boom

In 2024, global central banks purchased over 1,200 metric tons of gold, marking a 15% increase from 2023. This surge was driven by efforts to reduce reliance on the U.S. dollar. Investors responded by increasing their gold holdings, with demand for 1 oz gold bars soaring by 38%, highlighting bullion’s appeal in uncertain times.

💡 Takeaway: If your priority is pure gold investment, bullion is the better choice. However, if you want a blend of investment and aesthetic appeal, jewelries can be a smart alternative—especially when focusing on high-purity, well-crafted pieces.

Shop Now: 10.75mm 10k Yellow Gold Semi Solid Miami Cuban Chain

Why Now Is the Best Time to Invest in Gold

With gold prices hitting record highs in 2024 and ongoing economic uncertainty, jewelries remain a valuable investment option. Whether you choose luxury brand pieces, 22K traditional gold, or simple investment-grade jewelry, gold offers a tangible way to preserve and grow your wealth.

💰 Start your gold investment today! Browse our collection of investment-grade jewelries and bullion to secure your financial future.

Want to Learn More About Gold IRAs?

A Gold IRA is a tax-advantaged way to invest in gold while protecting your retirement savings. Our comprehensive guide will help you understand how to diversify your portfolio with physical gold.

Uncover the Truth About the Banking System

Banks and fiat currencies are losing purchasing power due to inflation and debt-driven economies. In Gold vs. The Banking Cartel, Dr. Perry Kyles exposes why gold is the superior form of saving.

📚 Read Gold vs. The Banking Cartel

Final Thoughts

Jewelries are more than just a luxury—they’re a tangible asset with long-term value. Whether you’re looking to resell for profit, hedge against inflation, or pass wealth down through generations, investing in high-purity gold jewelry can be a smart financial move.

As gold demand continues to rise in 2025 and beyond, now is the time to consider gold as a cornerstone of your investment portfolio. Are you ready to secure your wealth?

💡 Let us know in the comments: Do you prefer investing in gold jewelry or bullion?