Election Shockwaves: How Political Outcomes Shake Financial Markets

Election has a unique ability to stir up financial markets, often causing both excitement and unease. Political outcomes directly influence economic policies, trade agreements, and market sentiment, which in turn impact the stability of investments. In this context, gold emerges as a reliable safe haven, offering stability when other assets falter.

The Volatility of Markets During Elections

Historically, election years have been marked by stock market fluctuations. For example, during the 2020 U.S. presidential election, the S&P 500 index saw sharp swings as investors speculated on policy shifts. Similarly, in 2024, the global markets reacted to the election results in major economies like India and Brazil, with local currencies facing devaluation and stocks experiencing volatile trends.

Gold, however, told a different story. Its price rose by 15% in 2024, driven by uncertainty about fiscal policies and geopolitical risks. Unlike stocks, which are susceptible to market timing and corporate performance, gold’s value remains independent, making it a go-to asset for wealth protection.

Why Gold Shines During Election Uncertainty

Election outcomes often lead to policy changes that can destabilize economies temporarily. Increased government spending, tax reforms, or shifts in trade policies can erode confidence in fiat currencies. Gold, being a tangible and universally accepted asset, is immune to these influences. It acts as a hedge against inflation and currency fluctuations, providing security when the financial system feels uncertain.

For instance, in the wake of the 2024 elections in Europe, fears of economic instability due to policy transitions caused the Euro to weaken by 10% against the U.S. dollar. Gold, conversely, saw a surge in demand, demonstrating its role as a stabilizer in unpredictable times.

Take Action: Secure Your Wealth with Gold

Don’t let political uncertainty put your wealth at risk. At The Gold Marketplace, we offer a wide range of gold products — from bullion bars to collector coins — designed to protect your assets and provide peace of mind.

Start today:

- Visit our Gold IRA Guide to learn how to diversify your portfolio with tax-advantaged gold investments.

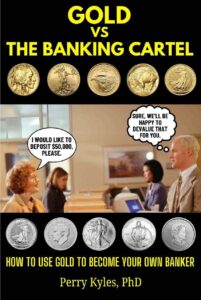

- Grab a copy of our insightful book, Gold vs. The Banking Cartel, and discover why gold outshines traditional investments during volatile times.

Elections may come and go, but the value of gold endures. Make the choice to safeguard your future by investing in a timeless asset today!