Investing in gold has been a trusted method of preserving wealth for centuries, and today, Gold IRAs offer a modern way to incorporate this time-tested asset into your retirement strategy. However, like any investment option, Gold IRAs are often surrounded by myths that can create confusion or deter potential investors. In this blog post, we will debunk some of the most common myths about Gold IRAs and provide clarity on their actual benefits, addressing concerns like liquidity, security, and profitability.

Myth 1: Gold IRAs Lack Liquidity

Reality: One of the most persistent myths is that Gold IRAs are illiquid and difficult to access when needed. The truth is that while the IRS has rules regarding withdrawals from IRAs, including penalties for early withdrawals (before age 59 ½), Gold IRAs are no more illiquid than traditional IRAs.

Like other IRAs, you can take distributions from a Gold IRA when you retire, and your custodian can easily help convert your gold into cash if needed. Additionally, some Gold IRA providers offer buyback programs, allowing you to sell your gold directly to them when the time is right, ensuring liquidity is not an issue.

Myth 2: Gold IRAs Are Risky and Unstable

Reality: Gold has long been considered a safe-haven asset, especially during economic downturns or market volatility. While no investment is entirely without risk, gold has historically maintained its value and even thrived when traditional assets like stocks and bonds falter. Gold IRAs offer diversification, helping to protect your retirement savings from inflation and economic instability.

Unlike stocks or bonds, the value of gold doesn’t depend on a company’s performance or market trends. Its stability is rooted in its physical nature and long-standing demand, making it a prudent choice for long-term wealth preservation.

Myth 3: Gold IRAs Are Expensive and Complicated to Set Up

Reality: Many people believe that setting up a Gold IRA is expensive and involves complicated procedures. In reality, while there are some initial setup fees, maintaining a Gold IRA is no more costly than traditional IRAs that require management and custodial fees.

At The Gold Marketplace, LLC, we guide you through each step of the process. From choosing a custodian to selecting the right precious metals, our Gold IRA guide provides an easy-to-follow plan to help you set up your account and begin investing in gold.

Additionally, a reputable custodian will handle the logistics, ensuring that your investment is IRS-compliant and stored in an approved depository. Once established, managing your Gold IRA is no more complicated than any other retirement account.

Myth 4: Gold IRA Don’t Offer Significant Profitability

Reality: Gold IRAs offer more than just security—they can also deliver substantial long-term gains. Gold’s price tends to increase during times of inflation or economic uncertainty, making it an excellent way to preserve and potentially grow your retirement savings. Unlike paper currency, which loses value over time, gold tends to hold or even increase its value, especially during financial crises. By diversifying your portfolio with a Gold IRA, you can reduce the risks associated with market volatility while positioning yourself for solid returns over time.

Our Gold IRA Guide

Setting up and managing a Gold IRA might seem overwhelming if you’re new to this investment option. But, our Gold IRA guide at The Gold Marketplace, LLC makes the process straightforward. Our guide is designed to educate and assist you, making your journey into Gold IRAs smooth and rewarding.

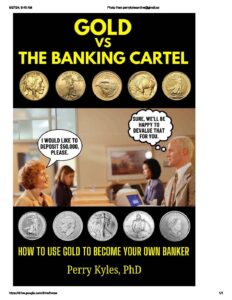

Our Book Gold vs. The Banking Cartel

If you want to dive deeper into this, check out our book, Gold vs. The Banking Cartel. In this book, we explore the flaws in the current banking system and the risks associated with paper currency. We also dedicate an entire section on the growth potential of Gold IRAs. It’s a must-read for anyone serious about protecting their wealth.

Gold IRAs offer a unique blend of stability, profitability, and security that many traditional investment options can’t match. By debunking the myths surrounding them, you can better understand the real advantages of investing in gold for your retirement. If you’re ready to take control of your financial future, consider a Gold IRA as part of your long-term strategy.

Ready to explore your Gold IRA options? Contact The Gold Marketplace, LLC today and get started!