Gold IRA

Self-Directed Precious Metals IRAs

Your Gold IRA In 3 Easy Steps

Speak With A TGM Representative

The representative will answer any questions you have and help you to formulate an acquisition strategy. Call us at 1-800-960-6280

Fund Your Account

Our custodian, Equity Trust, will contact you right away to fund your account.

Execute The Trade

Your TGM representative will review your acquisition strategy with you and execute the trade for your precious metals.

Here Is Why You Need A Gold IRA

What Is A Gold IRA?

A self-directed Individual Retirement Account (also known as a Gold or Precious Metals IRA) has gained a lot of popularity recently, especially among investors who seek stability and diversification in their portfolios. With the help of this financial tool, investors can increase the amount of tangible precious metals in their tax-sheltered retirement accounts—such as coins and bars. As a traditional hedge against inflation and geopolitical crises, precious metals are a great method for long-term investors to diversify their holdings and move away from paper assets.

Almost all Gold IRA owners want to preserve their wealth over the long term, and investing in precious metals is a safe, reliable, and effective way to sustain asset growth over that time. All physical precious metals are held in an IRS-approved vault until the owner retires, at which time they can be sent straight to you or quickly turned into cash to further protect and secure your investment. Remember that there are no taxes associated with rolling over or transferring an existing retirement account.

Why Should You Consider Gold For Your IRA?

Tired of your dollars losing value? Everyday items are costing more thanks to inflation and government printing money (QE). Your savings might be “safe,” but they buy less each year.

Most investments feel shaky too. They’re tied to the same currency as groceries, so they suffer as it weakens. Gold to the rescue! Historically, gold has been a shield against inflation, protecting your purchasing power over time. It can even grow in value as other assets struggle. National debt got you nervous? It’s massive and keeps climbing. Many fear it’s unsustainable, potentially leading to market panic. Gold doesn’t care about market cycles. Unlike stocks or bonds, it’s seen as a safe haven, a way to protect your retirement even when things get bumpy. Think gold might be right for you? Do your research and talk to a financial advisor. It could be the key to securing your financial future.

Precious metals are an asset type that has several advantages over other popular investment options. The advantages of gold include its track record of monetary stability during recessions, its superior defense against currency depreciation, and its fixed supply, which is unlikely to alter in the near future. To learn more about how gold stacks up against some other well-liked investment types, continue reading.

Gold vs. Stock Market: Risk against return is the name of the game when it comes to retirement planning. The preservation and availability of your hard-earned money upon retirement is, after all, the most crucial retirement objective. When prudent individuals wish to shield their retirement assets from the volatility of the market, they work with us with an eye toward the future.

History Of The Gold IRAs

The Employee Retirement Income Security Act established standard IRAs in 1974, but Gold IRAs weren’t released for several decades.

The Taxpayer Relief Act of 1997 brought in the era of precious metal individual retirement accounts. Because of this Act, the IRS increased the amount of precious metal that can be held in an IRA to include U.S. gold, platinum and palladium coins that weigh 1, ½, ¼, or one tenth of an ounce as well as U.S. silver coins that weigh one ounce.

Be aware that in order for any of these metals to be eligible for an IRA, the IRS requires that they meet a minimum purity criterion.

- Gold must be 99.5% pure

- Silver must be 99.9% pure

- And Platinum and Palladium must be 99.95% pure

Types Of Gold IRAs

Considering Gold for your retirement? Here are the 3 ways to do it:

- Traditional Gold IRA: This is the most common option. You contribute pre-tax dollars, reducing your current taxable income. Your investment grows tax-deferred, and you pay taxes when you withdraw in retirement. Think of it as tax-advantaged savings for later.

- Roth Gold IRA: Here, you contribute already-taxed dollars. No immediate tax benefit, but your qualified withdrawals in retirement are tax-free. It’s like paying taxes upfront for tax-free retirement income.

- SEP Gold IRA: This is for self-employed folks and small business owners. Similar to a Traditional Gold IRA, you contribute pre-tax dollars and get tax-deferred growth. However, contribution limits are higher.

How Does A Gold IRA Work?

Steps to Start Investing in a Gold IRA & How do I start a gold IRA?

Ready to add some sparkle to your retirement plan? Here’s a quick guide to getting started with a Gold IRA:

Since we already covered what a Gold IRA is, let’s jump right into the steps:

- Find your treasure chest: Choose a custodian specializing in Gold IRAs. They’ll handle paperwork and secure storage for your precious metals.

- Pick your pirate’s gold: Decide on the type of gold (coins, bars, etc.) based on your investment goals and IRS regulations.

- Fill your treasure map: Fund your Gold IRA with eligible retirement funds. Remember, contribution limits apply!

- Set sail for wealth: Choose an investment strategy with your custodian’s guidance. Do you want steady growth or a chance for bigger gains?

5. Sit back and relax (mostly): Monitor your investment and make adjustments as needed with your custodian’s help. Remember, investing involves risk, so be prepared for market fluctuations.

Remember, this is just a starting point. Before embarking on your Gold IRA adventure, consult a financial advisor to ensure it aligns with your overall retirement plan.

The Pros and Cons Of Gold IRAs

Before diving into the world of Gold IRAs, weigh the good and the bad:

Just like any investment, Gold IRAs come with a mix of potential benefits and drawbacks. Understanding both sides helps you make informed choices and navigate the investment landscape more wisely.

On the bright side:

- Shimmering security: Gold can act as a hedge against inflation and economic uncertainty, potentially offering stability when other markets falter.

- Tax havens: Depending on the type of Gold IRA, you might enjoy tax breaks on contributions or tax-free withdrawals in retirement.

- Diversification delight: Adding Gold IRAs to your portfolio diversifies your assets, potentially spreading risk and boosting resilience.

But beware the shadows:

- Treasure chest fees: Storing and securing physical gold often incurs additional fees compared to traditional IRAs.

- Limited liquidity: Selling your gold quickly might be difficult, unlike readily tradable stocks or bonds.

- Shiny, but not always growing: Gold doesn’t generate income like stocks or bonds, so its value primarily relies on price appreciation.

Remember, knowledge is power: Before making any investment decisions, consult with a financial advisor to ensure Gold IRAs fit your individual goals and risk tolerance. It’s not just about the glitter; it’s about making smart choices for your financial future.

Experience A “Hassle-Free” Gold IRA Transfer

Being a leader in the Gold IRA market, our mission at The Gold Marketplace is to streamline the process of obtaining this wonderful investment option for Individual Retirement Accounts. Our skilled team of experts is knowledgeable about all of the typical dangers, fines, and investor queries and concerns related to moving your retirement funds. We will provide you the tools you need to take charge of your future and make wise decisions.

If you already have an IRA, you can use a procedure called a direct transfer to transfer part (or all) of it to your new self-directed Gold IRA. One of our Precious Metals Specialists will competently assist you when you’ve decided to finish the transfer.

How to Invest in a Gold IRA

Investing in gold through an Individual Retirement Account (IRA) can be a calculated decision to protect your assets from market swings and diversify your retirement portfolio. Nevertheless, it can be difficult to navigate the Gold IRA investment procedure. The Gold Marketplace makes this process easier for investors by walking them through every step to guarantee a seamless and legal investing experience.

Understanding Gold IRAs

In addition to standard IRA assets like stocks and bonds, investors can keep genuine precious metals such as gold, silver, platinum, and palladium in a gold individual retirement account (IRA). A hedge against inflation and currency depreciation may be offered by this diversification.

Setting Up the Gold IRA:

Choosing a Custodian: Picking a trustworthy custodian is the first step in creating a gold individual retirement account. The Gold Marketplace ensures that your IRA is administered effectively and in compliance with IRS laws by partnering with reputable custodians that specialize in precious metals.

Opening an Account: The next step is to open a self-directed IRA account after choosing a custodian. The Gold Marketplace educates customers through the various account kinds, including regular and Roth IRAs, and helps with the required paperwork.

Funding Your Gold IRA

Rollovers and Transfers: You can fund your Gold IRA by making a direct transfer or rolling over money from an existing retirement account. The professionals at The Gold Marketplace can assist in navigating these choices to guarantee a free and penalty-free transfer of monies.

Direct Contributions: In addition, you are able to contribute directly to your Gold IRA up to the IRS-mandated yearly contribution limitations.

Selecting Your Gold Investments:

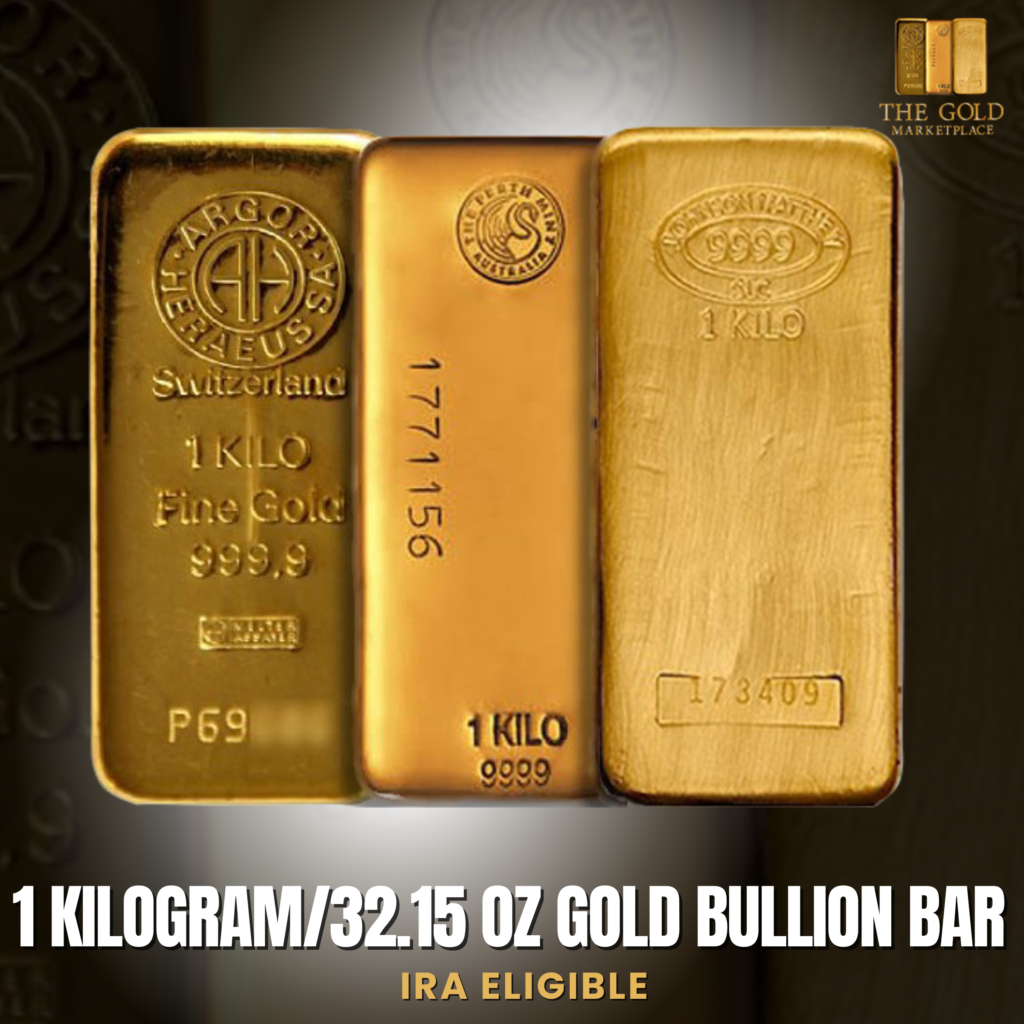

Selecting the Right Metals: The Gold Marketplace provides a range of IRS-approved gold coins and bars and will advise you on the best selections based on your investment goals and market performance. However, not all gold items are suitable for a Gold IRA.

Buying and Storing: After you choose your gold assets, The Gold Marketplace helps with the purchase and makes arrangements for safe storage in an IRS-approved depository. This procedure guarantees that your gold is completely insured and stored securely.

Managing and

Reviewing Your Gold IRA:

Ongoing Portfolio Management: The Gold Marketplace provides ongoing support in managing your Gold IRA, including regular reviews and updates on the performance of your gold investments.

Making Adjustments: As market conditions change or as you approach retirement, you may need to adjust your portfolio. The Gold Marketplace offers the flexibility to rebalance your investments, ensuring they align with your evolving financial goals.

What is a Gold IRA Rollover?

A Gold IRA rollover is vital for diversifying their retirement savings with precious metals. This process involves transferring funds from an existing retirement account into a Gold IRA, a specialized individual retirement account that includes gold and other precious metals. Understanding and executing a Gold IRA rollover correctly is crucial for maintaining the tax-advantaged status of your retirement funds.

Understanding The Rollover Mechanics:

There are two main paths to navigate your rollover:

- Direct Rollover: This is the smoother route, where your current account custodian transfers funds directly to your Gold IRA, keeping your money safe and untouched.

- Indirect Rollover: Here, you receive the funds from your old account and have 60 days to deposit them into your Gold IRA. Make sure to act swiftly to avoid taxes and penalties!

Why Consider a Gold IRA Rollover?

1. Don’t Put All Your Eggs in One Basket: Diversify your retirement portfolio with a Gold IRA! Not all your retirement savings should be tied to the stock market. By adding gold, you reduce dependence on any single asset class, spreading the risk and potentially smoothing out market bumps.

2. Weather the Storm: Imagine your retirement savings as a cozy nest egg. Gold has a long history of acting as a shield against inflation. While currency values may fall, gold often holds its own, protecting your purchasing power throughout life’s storms.

3. Grow Your Golden Harvest: Sure, gold prices dance around, but over time, the trend leans upward. By including gold in your retirement plan, you tap into potential long-term growth, adding another layer of security to your future comfort.

Navigating the Rollover Process with The Gold Marketplace:

Confused about Gold IRAs? Let The Gold Marketplace be your expert guide! They navigate the entire process, helping you choose the right rollover type and ensuring it follows strict IRS rules to avoid any tax headaches.

Stress-Free Setup & Funding: Don’t worry about paperwork or transfers. The Gold Marketplace smoothly sets up your Gold IRA account and seamlessly transfers funds from your existing accounts, making the process a breeze.

Gold Expertise at Your Fingertips: Not sure which gold products are best for your IRA? The Gold Marketplace’s experts help you select the perfect options that comply with all regulations, so you can invest with confidence.

Common Questions & Facts on Gold IRA Investments

Unlock the Potential of Gold IRAs with These Account Options:

Ready to diversify your retirement portfolio with precious metals? Great! But which accounts can you use to fund your Gold IRA? Here's the good news: you have many choices!

For IRA Owners:

Beyond IRAs:

Did you know that since 1998, your IRA can go beyond stocks and bonds? That's right, thanks to the IRS, you can hold gold, silver, platinum, and palladium in your retirement account!

Why choose a precious metals IRA?

Keeping your golden nest egg safe:

Unlike your regular piggy bank, Gold IRAs prioritize security. That's why the government sets strict rules for coins allowed in these accounts. Think of it like having Secret Service protection for your precious metals!

What's in, what's out?

Forget foreign coins or anything minted by non-governments – they're not invited to the party. However, don't worry, there are plenty of approved options:

That's why experts recommend holding Gold IRAs for at least 5-10 years, or even longer. This gives your gold time to weather market ups and downs and potentially outpace inflation, ultimately growing your nest egg.

One crucial concern that frequently comes up when investors think about diversifying their portfolios is: Is gold a good investment, especially in light of 2024? Understanding gold's qualities as an investment asset and how it fits into a larger financial plan is crucial to providing a response.

The world economy is expected to grow slowly in 2024, with inflation remaining a concern. Rising interest rates from central banks aim to fight inflation but could also slow growth. Emerging markets might fare better than developed economies. Stock markets could be volatile.

Exceptional Customer Service and Support

More than just a seller: At The Gold Marketplace, we are your investing partner. We personalize your experience, crafting investment plans based on your unique needs.

Investing empowered: Our commitment doesn’t end with the transaction. We provide continuous support and educational resources, equipping you with the knowledge to make informed decisions and navigate the precious metals market confidently.