Transitioning Your Savings into Gold (Step-by-Step)

In this guide, we’ll explore how transitioning your savings into gold can secure your wealth, reduce vulnerability to inflation, and create a stable foundation for future financial plans. As inflation, currency fluctuations, and economic shifts persist, many are seeking alternatives to traditional banking and cash savings.

Why Transitioning to Gold Is a Strategic Move

For years, traditional savings accounts have been standard, convenient options for storing wealth. However, there are drawbacks, such as inflation eroding purchasing power. According to a study by the Federal Reserve, the average annual inflation rate in the U.S. hovers around 3%, meaning $100 today will likely be worth only $97 in purchasing power next year. Factor in banking fees and low-interest rates, and you’re looking at a slow decline in your wealth’s real value.

Gold, on the other hand, has consistently retained its purchasing power over centuries, weathering economic crises, wars, and currency devaluations. It serves as a hedge against inflation and a safeguard in times of financial instability, providing a valuable alternative to cash.

Step 1: Understanding Your Goals for Wealth Protection

Before converting any part of your savings, it’s essential to clarify your financial objectives. Are you looking to protect against inflation, hedge against currency risk, or store a portion of your wealth in a stable asset? By pinpointing these goals, you’ll be better positioned to decide how much to allocate toward gold and which forms (such as coins, bars, or Gold IRAs) best suit your needs.

Step 2: Choose the Right Type of Gold Investment

Gold can take many forms, each with unique benefits depending on your investment strategy:

- Physical Gold (Coins and Bars): Tangible assets you can hold and store yourself, or in a secure depository.

- Gold IRA: A self-directed Individual Retirement Account that allows you to hold physical gold as part of your retirement savings.

- Gold ETFs or Stocks: Exchange-traded funds or stocks in gold mining companies offer an option to indirectly invest in gold.

Step 3: Start Small, Build Gradually

Many new gold investors choose to transition a portion of their savings over time, which helps spread out the costs and allows for market monitoring. For instance, instead of converting all at once, consider allocating a fixed percentage of your income or savings monthly toward gold. As with any investment, diversification is key, and this method ensures that you don’t overexpose yourself to one asset at a single point in time.

Stat Insight: According to the World Gold Council, investors typically allocate between 5% and 20% of their portfolio to precious metals as a hedge against economic instability and market downturns.

Step 4: Set Up Secure Storage Solutions

With physical gold, proper storage is critical. Depending on your preference, you can choose to store it in a bank safe deposit box, a home safe, or a certified depository, which often comes with insurance options. For those interested in long-term wealth protection, a Gold IRA offers an additional layer of security, as the gold is required to be stored in an IRS-approved depository.

Step 5: Track and Review Your Investment

While gold doesn’t yield dividends or interest, its value can still fluctuate over time. Reviewing your gold investment periodically ensures it aligns with your financial goals. If you’re saving for retirement, for instance, consider how gold compares to other assets in your portfolio to maintain balance and avoid overexposure to any one asset class.

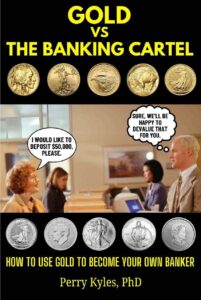

Beyond the Basics: Discover the Bigger Picture in Gold vs the Banking Cartel

Uncover the truth about banking. Learn how gold protects your wealth in our book, “Gold vs the Banking Cartel.” We discuss how banks devalue cash through inflation and how gold can help you protect your wealth long-term.

Transition to Gold, Secure Your Future

In today’s economy, safeguarding your savings from inflation and economic instability is more important than ever. Transitioning part of your wealth to gold provides a reliable buffer, offering security in an unpredictable landscape. Start your gold journey today. Invest in physical gold or a Gold IRA to secure your future.

Ready to take the next step? Explore The Gold Marketplace today to discover gold’s potential.